GroceryAid works with GamCare to support colleagues who may feel their gambling habits are getting out of control, or who are impacted by someone in their household gambling.

To mark its 25th anniversary, GamCare the leading UK provider of support for gamblers, has looked into the key issues surrounding gambling harms today, from the increases in cost of living to cryptocurrency, to raise awareness and encourage those impacted to reach out for support.

GamCare, commissioned a survey with You Gov, asking a nationally representative sample of 4000 people, across the UK, for their views on key issues from online gambling and sport betting to newer activities facing gamblers today.

You Gov data shows nearly half (46%) of those surveyed are worried or very worried about their financial situation. The figure is significantly higher in those who report losing significant amounts of money gambling; 61% of this group are worried or very worried about their finances.

GamCare advisors have reported several worrying trends from callers:

- People on Universal Credit gambling to make extra money to cover their bills but unfortunately end up in a worse financial situation as a result

- Gambling addicts relapsing as financial pressures have heightened and they have needed to seek more support for their gambling

- Callers unable to pay off existing gambling debts

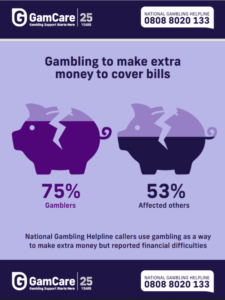

GamCare’s latest annual figures show that 75% of gamblers and 53% of affected others using the National Gambling Helpline reported financial difficulties, and 66% of gamblers disclosed having debt. In treatment, 80% of gamblers and 56% of affected others reported financial difficulties and 66% of gamblers reported debt.

Increased accessibility of online gambling and prevalence of traditional gambling

The rising cost of living coupled with the increased accessibility of online gambling, which was, at times, the only form of gambling available during the pandemic, can be particularly challenging for those harmed by gambling. Despite the increased popularity in newer forms of betting such as skins and loot boxing, more traditional forms of betting like horse and greyhound racing are still prevalent today.

- The YouGov data shows that horse racing (36%) followed by football (21%) are the most popular sporting events to place a bet on in the last 12 months

- Problem gamblers and those with a moderate level of problem gambling mostly bet on football matches (56% and 60%) and horse racing (29% and 48%)

- Six in ten (59%) of 16–24-year-olds who gamble have not placed a bet on a sporting event in the last 12 months, but a 17% of this group report that they own cryptocurrency

High-risk trading and investing, such as cryptocurrency, are a growing concern for problem gamblers

As well as traditional gambling- like football or horse race betting- GamCare is seeing new concerning trends, primarily the growing risk to consumers from high-risk trading and investing, including cryptocurrencies. Although many people invest without experiencing harms, there is an increasing concern for people experiencing issues related to cryptocurrencies, particularly for problem gamblers.

The survey data suggests that those who have experienced serious gambling harms are more likely to experience negative impacts when trading.

- 43% of problem gamblers own cryptocurrency

- Two thirds of low-level problem gamblers (66%) are motivated to buy cryptocurrencies to make money, this is significantly higher than problem gamblers (24%)

- Those whose gambling is classed as problematic are much more likely to report negative impacts from purchasing cryptocurrency than the general population. One quarter (25%) of this group want to invest more to recoup their losses (v 7%), 22% say they have not been able to pay essential bills (v 4%) and 21% say they have felt overwhelmed by the situation (v 6%)

Lack of parental awareness

GamCare is becoming aware of new activities that could pose a risk in the future. Nearly a fifth (17%) of all 16- to 24-year-olds surveyed said they owned cryptocurrency, with 16- to 34-year-old males being the most likely to report owning cryptocurrencies – 33% have bought it at some point. The survey also shows that parental awareness and levels of confidence in speaking to children about newer trends are low.

- Half of parents of children aged under 18 (51%) would feel unconfident explaining what cryptocurrency is

- 42% of parents of children aged under 18 would not be confident talking to their children about loot boxes, compared to a third of this audience (33%) who would. Among all parents, the number of women (50%) who are not confident is higher than men (33%)

- 79% of parents of children aged under 18 have never heard of skins betting

If you’re in need of gambling support, through GroceryAid you can access the free, impartial advice and information from GamCare to help alleviate your worries and stress.

GroceryAid’s free and confidential Helpline is available 24 hours a day, 365 days of the year, to all grocery colleagues and their spouse/partner and dependants over 18. We offer a translation service for callers with access to over 200 languages, on request, for colleagues who would like to speak to a counsellor in their first language.

Call our Helpline: 08088 021 122